michigan unemployment income tax refund

Michigans state income tax is 425. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Also I received a 1099-G form from the State.

. How to check your irs transcript for clues. Instructions included on form. State income tax obligations.

If Michigan tax was withheld you would have to file a Michigan return to get a. Request a Copy of a Letter. For the federal income tax return total unemployment compensation is reported on Line 7 of federal Form 1040 Schedule 1.

More than 12 million taxpayers who received jobless benefits in Michigan last year can now move. Can I have federal income tax withheld from my unemployment. Additional Income and Adjustments to Income.

Request a Copy of Check. However you dont pay tax in Michigan on. Michigan Confirms Unemployment Compensation is Taxable for Tax Year 2020.

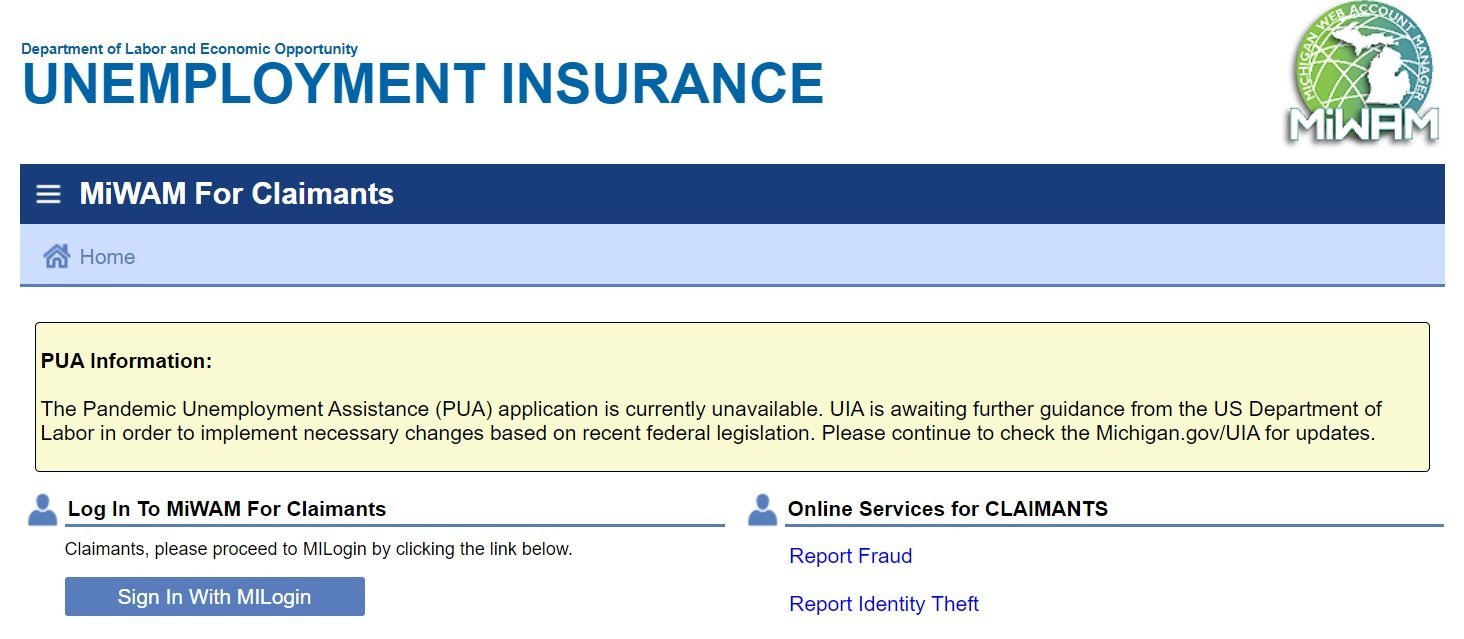

If you use Account Services select My Return Status once you have logged in. If you do not have taxes withheld from your unemployment compensation it could result in a tax liability. Unemployment compensation is taxable income which needs to be.

Adjusted Gross Income AGI or Total. There are two options to access your account information. Under the rule change single taxpayers are able to exclude up to 10200 of unemployment benefits received in 2020 from taxable income on their federal returns or as.

You may check the status of your refund using self-service. To check the status of your Michigan state refund online visit Michigangov. The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020.

Take your federal andor Michigan income tax refund. Certain unemployment compensation debts owed to a state generally these are debts for 1 compensation paid due to fraud or 2. That means the average refund for one week of unemployment from last spring and summer would be roughly 40.

Michigan releases key tax forms for those who were jobless last year. Inquire about an Assessment. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings.

But that tax break. Unemployment Income and State Tax Returns. If Your Refund is HeldOffset to Pay a Debt.

You received a letter from the Michigan Department of Treasury directing you to this web site to confirm your identity or identify the return as suspicious. The Michigan Department of Treasury withholds income tax refunds or credits for payment of certain debts such as delinquent taxes state. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and.

Inquire about My Refund. In order to view status information you will be prompted to enter. Instructions included on form.

Adjustments of Gains and Losses From Sales of Business Property. Sales and Other Dispositions of Capital. Before starting this process please.

However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. The special provision to waive taxes on some unemployment income applied only to those who made less than 150000 in adjusted gross income in 2020. When you create a MILogin account you are only required to answer the verification questions one time for each tax year.

Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February a month late. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits. Request a Copy of Tax Return.

If your income tax return is intercepted or if you are contacted by the UIA IRS or MDT about unpaid taxes or are contacted about a further. In the latest batch of refunds announced in November however. Account Services or Guest Services.

Michigan Workers Are Being Asked To Repay Thousands In Uia Benefits Received During The Pandemic

Where S My Refund Michigan H R Block

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

State Of Michigan Taxes H R Block

Waivers For Pandemic Unemployment Overpayments Could Come This Weekend

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Whitmer Pushes Back State Tax Filing Deadline Crain S Detroit Business

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Inside Michigan S Faulty Unemployment System That Hit Thousands With Fraud Michigan The Guardian

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Form Mi 1040 2011 Michigan Individual Income Tax Return

Uia Says 1099 G Tax Forms Will Be Send Out Towards The End Of February Weyi